Are you waiting for the post-pandemic property boom? News is, it started some time in 2020, in the popular suburbs. As the repo rate hit rock bottom during last year, real estate quickly became more affordable. And a pent-up demand kicked in. Although Cape Town currently reflects the lowest growth in property value, the affordable sectors have surged.

Good time to buy a home

A post-pandemic property boom may see a jump in the price of properties for sale. As buyer activity increases, stock will reduce. This could mean rising prices. So now is obviously a good time to buy. Specially with an interest rate hike on the cards. Securing a good mortgage rate, right now, is advisable.

Property professionals say that since June 2020, the residential market has been supported by first-time homebuyers. They have been taking advantage of the record-low interest rates. This has coincided with value-for-money opportunities in the current economic environment. Property came on the market as some incomes reduced. Affordability became an issue. Changing lifestyles and residential property preferences also drove buying activity. Leaving the city and getting out into the country became more popular. Confined living in the lockdowns saw inner city flat dwellers looking for wider horizons.

Houses under R1 million, with no transfer fees, are best sellers

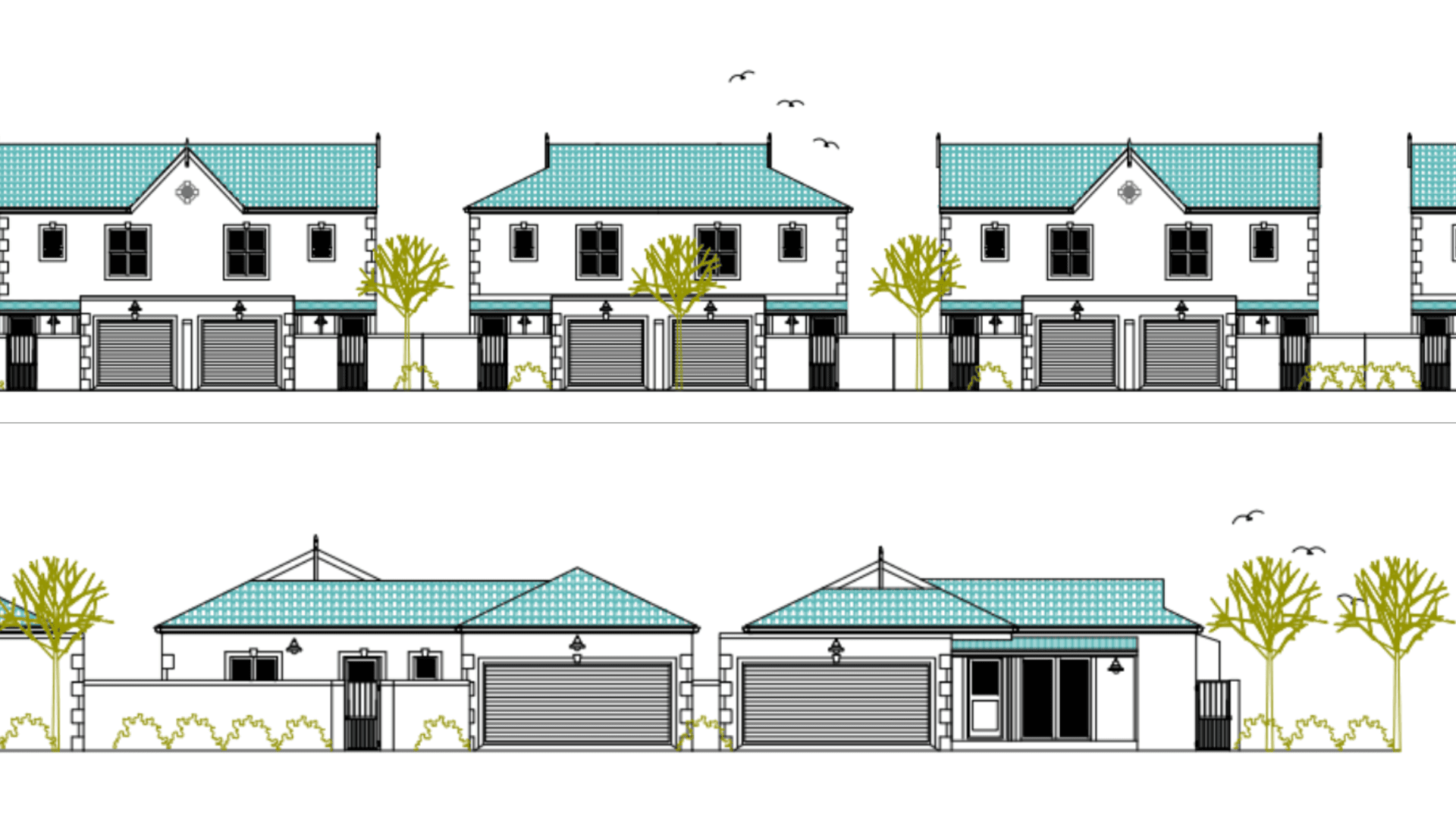

Buying a home during the pandemic offers both advantages and some difficulties. Getting out to browse property was difficult early on. But the pandemic has changed the way homes are marketed. Developers and sellers are making greater efforts to present their properties to buyers. This has meant that even in lockdown, on-line sales were facilitated by greater detail. Websites show images, diagrams, plans and even walk-through videos. Many sales have been based largely on on-line viewing.

The criteria for buying a home have changed, say agents. Buyers, stretched for cash, are often willing to forgo the three-bedroom house. Many settle for a two, or one bedroom apartment. In some cases, a lower priced property is bought for investment. But, other homeowners enjoy the freedom of smaller homes. Costs are lower, and shared facilities in some options help monthly budgeting. Developers, like Garden Cities, offer a wider choice of home sizes. As a result, they can satisfy the buying needs of a wider market.

Buying a house during the pandemic

We explored the influences and changes over the past 15 months and how to react to them. This could include adjusting your lifestyle to deal with the restrictions. Remember that valuable opportunities still exist and will arise as the situation eventually plays out. A rational choice of location and accommodation criteria go hand in hand with improving mental health. It removes stress. This results in a better balance with the need for wealth creation. Financial adjustments and budgeting could be another valuable facet.

Another choice families could consider is sharing living space. Converting a larger property to a multi-generational home. It’s an option many have successfully chosen. This allows cost-sharing, security – and proximity to helpful grandparents.

Life has been enormously changed by events of the recent past and immediate present. It remains an anxious time for everyone. The only way through this, is to accept and adapt. The answer might be in lifestyle changes that moderate the struggle.